The idea of selling a company that has been created with so much effort and dedication can be a difficult decision for many entrepreneurs. Often, so much time, energy, and resources have been invested in creating and growing the company that it is perceived as an integral part of their identity. This can lead to some psychological dynamics that can sometimes compromise the sales process, even when relying on an M&A consultant. Two psychological phenomena that can impact the decision to sell the company are the Endowment Effect and Overconfidence.

The Endowment Effect refers to people’s tendency to overestimate the value of objects they own. In the context of selling a company, this means that entrepreneurs may be inclined to value their company above its actual market value. In this way, it can be difficult for them to accept a reasonable selling price, even if it could represent an excellent monetization opportunity.

Overconfidence, on the other hand, refers to people’s tendency to overestimate their abilities and knowledge. In the sale of a company, this can lead entrepreneurs to think that they can get a higher selling price than is possible. In some cases, overconfidence can also lead entrepreneurs to underestimate the risks associated with selling the company, such as the loss of control or the impact on their personal reputation.

These two psychological aspects can make it difficult for entrepreneurs to make rational decisions during the company sales process and can compromise negotiations. In some cases, entrepreneurs may even decide to withdraw their company from the market, preferring to maintain control of the company rather than accept a selling price lower than their expectations.

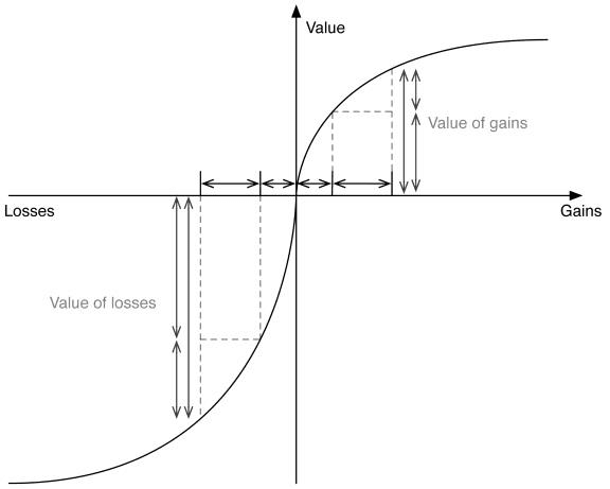

It is interesting to consider the value function of Kahneman and Tversky, a graphical representation of the above, which is used to describe how people evaluate decisions in risky situations. The function, which is represented by an S-shaped curve, shows how people tend to evaluate gains and losses differently. People tend to perceive the pain of loss more intensely than the joy of gain. This suggests that entrepreneurs may be more inclined to make decisions that minimize losses rather than maximize gains, which could influence the sales negotiation.

The trend of the mergers and acquisitions market in Europe has seen numerous interesting dynamics in recent times. There is a growing interest in M&A operations by an increasing number of entrepreneurs.

The trend seems destined to consolidate, as many European companies have already announced their intention to sell or acquire other companies in the coming months. However, the actual implementation of these transactions is not always assured, and difficulties related to the valuation of the companies involved or the choice of the ideal buyer are often encountered.

Despite this, it is evident that the M&A market in Europe offers numerous growth opportunities for companies that know how to seize them. Identifying the right partner and carefully managing every phase of the acquisition process is crucial to success in this strategic area for the future of businesses.

Selling a company can be an emotionally demanding process for entrepreneurs, who may feel attached to the company itself and overestimate its value. This can lead to price demands that have little market response and difficult negotiations. Moreover, overestimating their own abilities and knowledge can lead entrepreneurs to believe that they can manage the sales negotiation alone, without consulting support.

Instead, it is statistically relevant to rely on expert M&A consultants who can support them throughout the entire sales process, from the evaluation of the company to the negotiation of the price. In this way, entrepreneurs can obtain a realistic evaluation of the company and have a clear view of the market, allowing them to make informed and reasonable decisions.