October 18, 2024

- Introduction to Strategic Business Planning

Business plans are fundamental tools for the strategic and operational management of companies, integrating detailed analyses on cost and revenue optimization, CAPEX and OPEX analysis, management of future financial needs, reduction of operational costs, increase in production efficiency, and liquidity planning, to ensure sustainable growth and a solid competitive position in the market.

- Cost and Revenue Optimization Strategies

Cost and revenue optimization represents a fundamental pillar for business sustainability and growth. This strategy requires an integrated approach that balances expense reduction with revenue increase, aiming to maximize the overall profitability of the company.

2.1 Cost Analysis and Reduction

Regarding cost optimization, it’s essential to adopt a data-driven analytical approach. Detailed analysis of internal processes allows for identifying inefficiencies and waste, enabling targeted cost reduction interventions. An effective method is the implementation of process mining techniques, which use advanced algorithms to map and analyze business workflows, identifying bottlenecks and improvement opportunities.

The automation of repetitive processes emerges as a key strategy for reducing operational costs. The adoption of Robotic Process Automation (RPA) systems can lead to significant savings, especially in high-volume, low-complexity activities.

Strategic human resource management plays a fundamental role in reducing operational costs. The adoption of flexible work models, such as teleworking, can lead to significant savings on real estate and utility costs.

Supply chain optimization represents another crucial area for cost reduction. The implementation of Just-In-Time (JIT) techniques and lean manufacturing can significantly reduce inventory costs.

The adoption of efficient energy technologies represents a significant opportunity for long-term operational cost reduction. Investment in LED lighting systems, high-efficiency HVAC systems, and renewable energy sources can lead to substantial energy savings.

Finally, the review and renegotiation of contracts with suppliers can lead to significant savings. The adoption of strategic sourcing strategies, which include spend analysis, supplier segmentation, and value-based negotiation, can lead to cost reductions of up to 15-20% (1).

2.2 Revenue Optimization

On the revenue optimization front, it’s fundamental to adopt dynamic pricing strategies based on the perceived value by the customer. Cost analysis, combined with a deep understanding of the market and the company’s value proposition, allows for defining optimal pricing strategies.

Market segmentation and the implementation of differentiated pricing strategies for different customer segments can maximize overall revenues. The use of predictive analysis techniques and machine learning can significantly improve the accuracy of demand forecasts and price optimization. These tools allow for analyzing large volumes of historical and market data to identify complex patterns and dynamically adapt prices based on market conditions and predicted demand.

A crucial aspect of revenue optimization is the focus on customer experience and customer loyalty. Well-structured loyalty programs and targeted upselling and cross-selling strategies can increase the Customer Lifetime Value (CLV).

2.3 Performance Monitoring

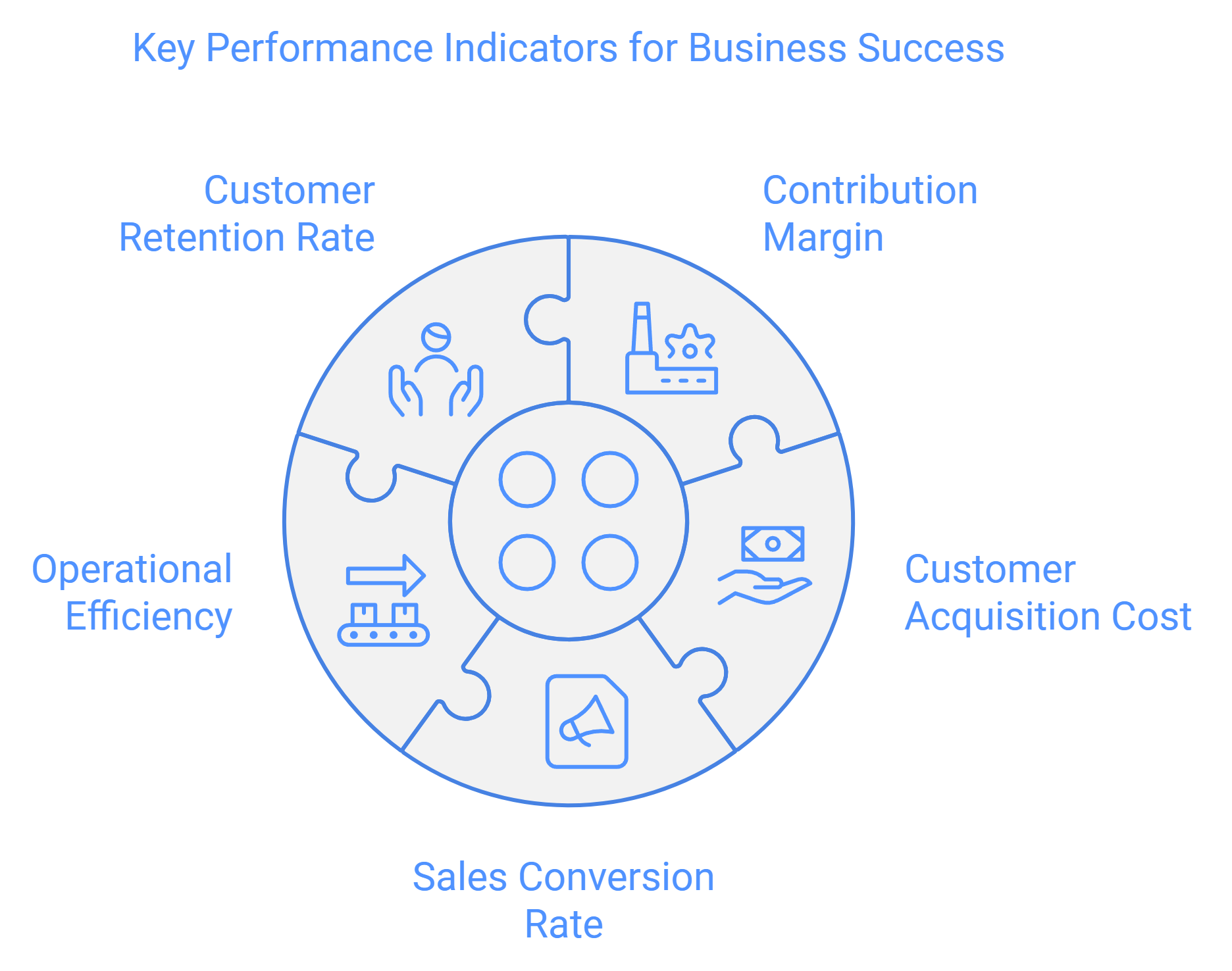

The implementation of a performance management system based on specific Key Performance Indicators (KPIs) for cost and revenue optimization is fundamental to monitor the effectiveness of adopted strategies. Some relevant KPIs include:

- Contribution margin per product/service

- Customer Acquisition Cost (CAC)

- Sales conversion rate

- Operational efficiency (output/input ratio)

- Customer retention rate

It’s important to emphasize that cost and revenue optimization should not compromise the quality of products or services offered. On the contrary, it should be seen as an opportunity to improve the overall efficiency of the company, increasing the value offered to customers and strengthening the competitive position in the market.

- Long-Term Capex and Opex Analysis

Long-term analysis of CAPEX (Capital Expenditure) and OPEX (Operational Expenditure) is fundamental for strategic financial planning and efficient management of company resources. This analysis requires a deep understanding of investment dynamics and operational costs in the context of an extended time horizon.

3.1 CAPEX Analysis

Regarding CAPEX, the long-term approach involves a detailed evaluation of investments in fixed assets, such as plants, machinery, and technological infrastructures. The Net Present Value (NPV) method is particularly relevant for this analysis.

Long-term CAPEX analysis must consider not only the initial cost of the investment but also future benefits in terms of operational efficiency, cost reduction, and growth potential. It’s essential to evaluate the impact of investments on the company’s fixed cost structure and its ability to adapt to technological and market changes.

3.2 OPEX Analysis

Regarding OPEX, long-term analysis focuses on forecasting and optimizing recurring operational costs. This includes expenses such as maintenance, personnel, utilities, and consumables. An effective approach is the use of Total Cost of Ownership (TCO).

Long-term OPEX analysis must consider factors such as inflation, technological changes, and potential operational efficiencies. It’s important to evaluate how CAPEX investments can influence OPEX over time, often leading to a reduction in operational costs through greater efficiency.

3.3 CAPEX-OPEX Trade-off

A crucial aspect of long-term CAPEX-OPEX analysis is the evaluation of the trade-off between the two. For example, a larger investment in CAPEX could lead to a reduction in OPEX in the long run. This trade-off can be analyzed using the concept of Total Cost of Ownership (TCO) and long-term Return on Investment (ROI).

3.4 Implementation of Advanced Technologies

The implementation of advanced technologies such as the Internet of Things (IoT) and artificial intelligence can significantly improve the accuracy of long-term CAPEX and OPEX forecasts. These tools allow for real-time monitoring of asset performance and predicting maintenance needs, thus optimizing both investments and operational costs.

3.5 Sustainability Considerations

Finally, it’s fundamental to consider the environmental impact and sustainability in long-term CAPEX-OPEX decisions. The adoption of eco-sustainable technologies could involve an increase in initial CAPEX but lead to significant reductions in OPEX in the long term, in addition to improving corporate reputation and compliance with environmental regulations.

- Integrated Management of Financial Needs and Liquidity

4.1 Determination of Financial Needs

The management of future financial needs represents a crucial element in corporate financial planning, requiring a strategic and analytical approach to ensure the sustainability and growth of the company in the long term. This management is articulated in three fundamental phases: needs analysis, resource procurement, and investment planning.

The first phase consists of the precise determination of financial needs, which can be defined as the quantity of monetary means necessary to acquire the essential productive factors for carrying out business activities. To accurately calculate financial needs, it is necessary to use a forecast income statement model that considers all expected inflows and outflows. The final balance of this statement, if negative, will represent the financial need to be covered.

4.2 Procurement of Financial Resources

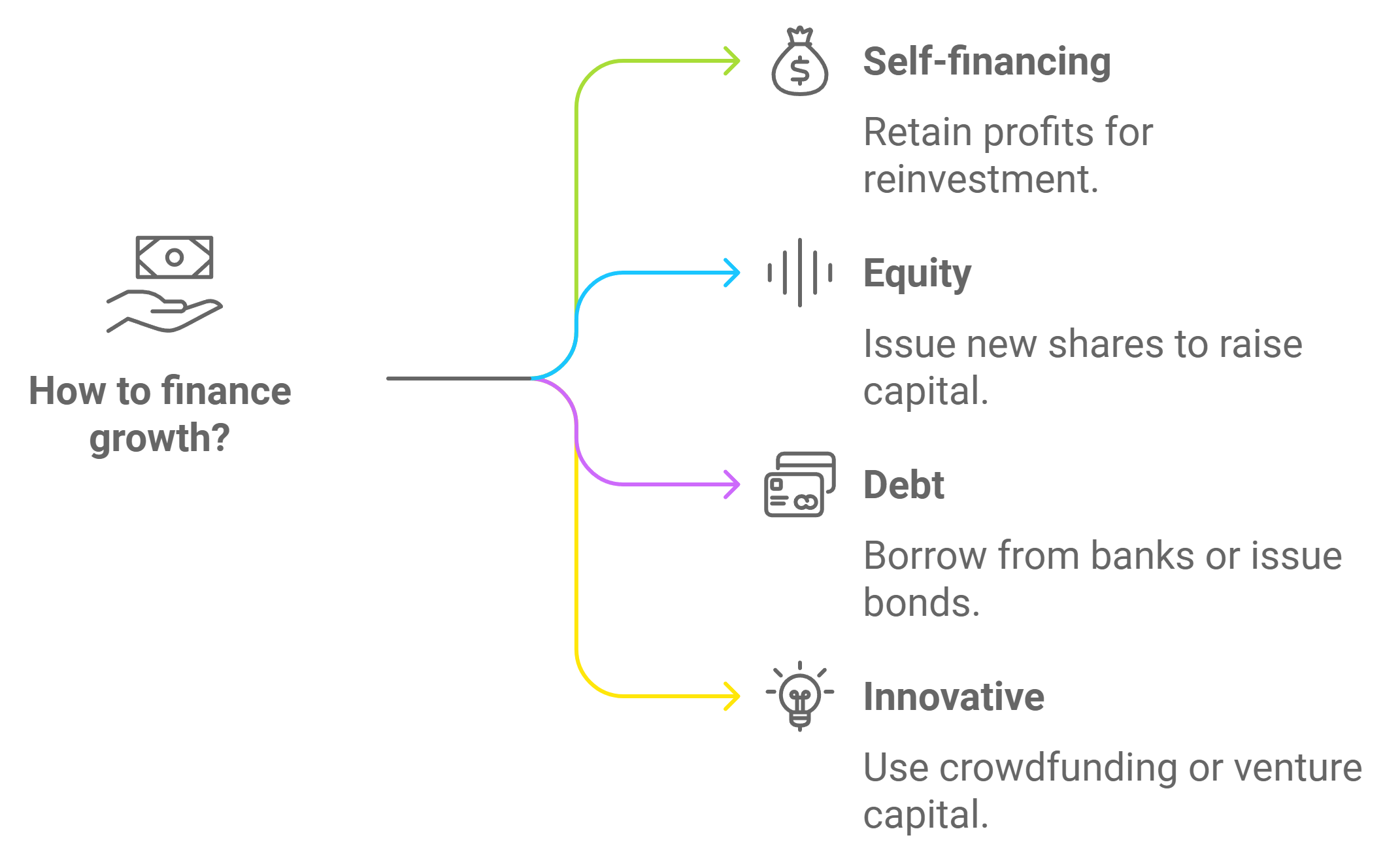

Once the need is quantified, the second phase focuses on procuring the necessary resources. This phase requires a careful evaluation of the various financing options available, considering factors such as the cost of capital, the optimal financial structure of the company, and capital market conditions. Options may include:

- Self-financing through profit retention

- Issuance of new equity capital

- Recourse to bank or bond debt

- Use of innovative financial instruments such as crowdfunding or venture capital

The choice between these options should be guided by a cost-benefit analysis that considers not only the financial aspect but also the impact on governance and strategic flexibility of the company.

4.3 Investment Planning

The third phase concerns investment planning, which must be aligned with the company’s growth strategy and supported by a detailed analysis of the return on investment (ROI). To evaluate the convenience of long-term investments, it is fundamental to use financial evaluation techniques such as Net Present Value (NPV) and Internal Rate of Return (IRR).

4.4 Risk and Uncertainty Management

A critical aspect in managing future financial needs is the consideration of risks and uncertainties. The implementation of scenario analysis techniques and stress testing can help evaluate the robustness of the financial plan under different market conditions. Furthermore, the use of financial hedging instruments can help mitigate risks related to interest rate and exchange rate fluctuations.

4.5 Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning in managing financial needs can significantly improve the accuracy of forecasts and the effectiveness of financial decisions. These tools can analyze large volumes of historical and market data to identify complex patterns and provide valuable insights for financial planning.

4.6 Liquidity Planning

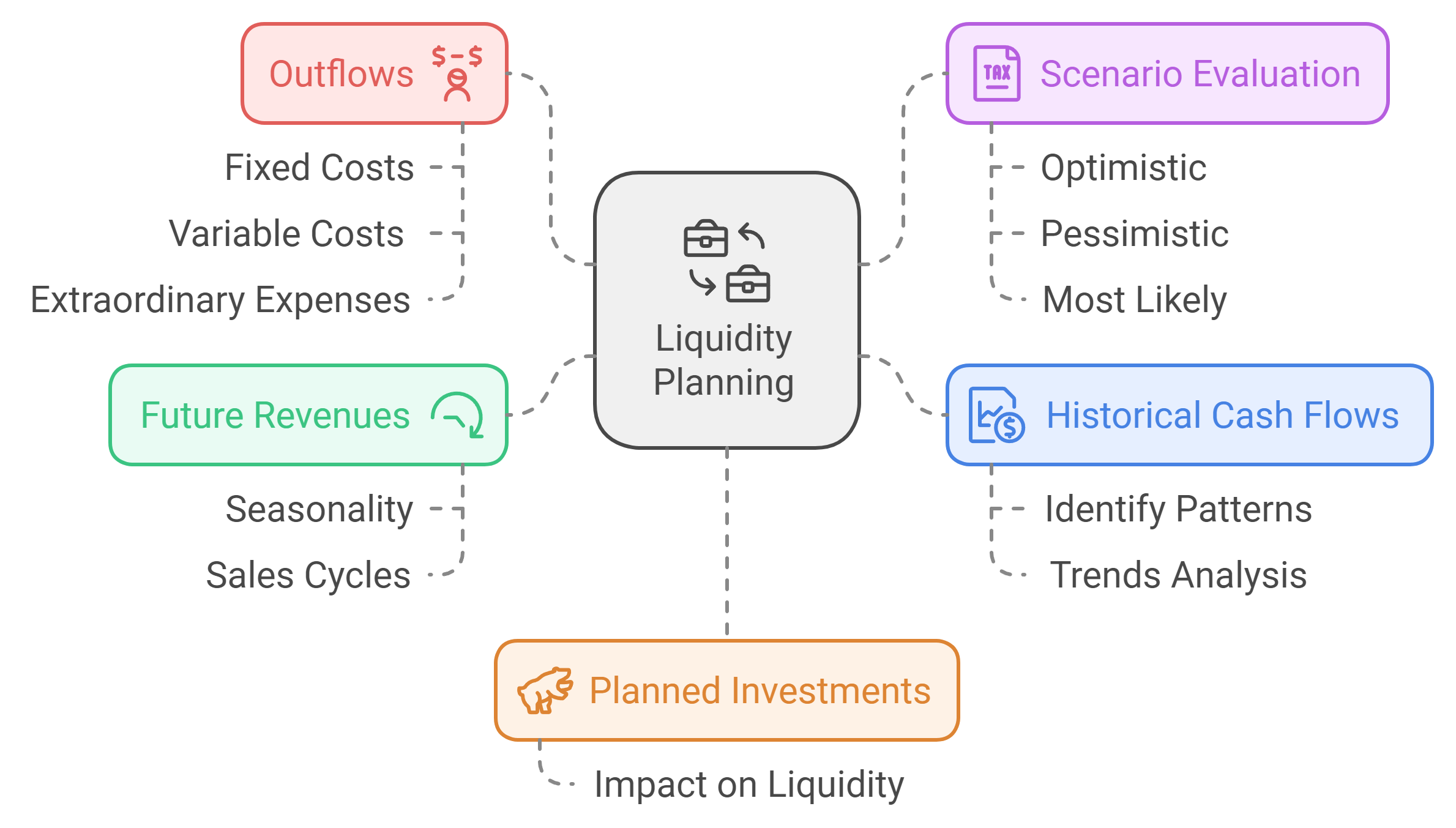

Liquidity planning is a crucial element in corporate financial management, essential to ensure the solvency and operational stability of the company in the short and long term. This process involves accurate forecasting and constant monitoring of cash flows, allowing the company to anticipate and effectively manage liquidity needs.

The liquidity plan, also known as cash flow forecast, is a fundamental tool that provides a detailed projection of expected financial inflows and outflows over a given time frame, usually from 6 to 12 months.

The importance of liquidity planning is underlined by the fact that in Switzerland, nine out of ten bankruptcies are caused by liquidity crises (2). Therefore, accurate liquidity management is not just good practice, but a necessity for business survival.

To implement effective liquidity planning, it is fundamental to:

- Analyze historical cash flows in detail to identify patterns and trends.

- Accurately forecast future revenues, considering seasonality and sales cycles.

- Accurately estimate outflows, including fixed costs, variables, and extraordinary expenses.

- Consider planned investments and their impact on liquidity.

- Evaluate different scenarios (optimistic, pessimistic, most likely) to prepare contingency plans.

To optimize liquidity management, companies can adopt various strategies:

- Accelerate the collection of receivables through stricter credit policies or the use of factoring.

- Negotiate more favorable payment terms with suppliers.

- Implement cash pooling systems to centralize and optimize liquidity management at the group level.

- Use financial instruments such as revolving credit lines to manage short-term fluctuations.

The implementation of advanced technologies, such as artificial intelligence and machine learning, can significantly improve the accuracy of liquidity forecasts. These tools can analyze large volumes of historical and market data to identify complex patterns and provide more precise forecasts.

It is essential that the liquidity plan is updated regularly, preferably on a monthly basis, to reflect changing market and business conditions. This continuous review process allows for timely identification of potential liquidity problems and adoption of corrective measures.

4.7 Dynamic and Iterative Approach

It is fundamental that the management of future financial needs is a dynamic and iterative process, subject to periodic revisions to adapt to changes in the economic and competitive context. Flexibility and the ability to adapt quickly are key elements to ensure effective financial management in a constantly evolving business environment.

- Increase in Production Efficiency

Increasing production efficiency represents a crucial objective for companies aiming to optimize processes, reduce costs, and increase competitiveness in the market. This section explores key strategies and technological tools to improve production efficiency.

5.1 Strategies for Production Efficiency

| Strategy | Description | Benefits |

| Process optimization | Analysis and improvement of workflows | Waste reduction, increased productivity |

| Automation and IoT | Implementation of technologies for automatic control and execution of processes | Greater precision, reduction of production times |

| Staff training | Continuous updating of employee skills | Performance improvement, error reduction |

| Predictive maintenance | Use of sensors and data analysis to prevent failures | Reduction of machine downtime, optimization of maintenance costs |

| Lean manufacturing | Application of lean production principles | Waste elimination, improvement of production flow |

Production efficiency is achieved by maximizing the capacity of a production system to generate quality output using available resources optimally. To measure and improve production efficiency, it is fundamental to implement a real-time data collection system that allows constant monitoring of production process performance.

5.2 Advanced Technologies for Production Efficiency

The adoption of advanced technologies such as the Internet of Things (IoT) and industrial automation plays a key role in increasing production efficiency. These tools allow not only to control and optimize the transport and delivery of products but also to reduce energy costs and minimize waste.

A crucial aspect for improving efficiency is the implementation of advanced monitoring and analysis systems. Platforms like VisioNando, for example, allow easy reporting of faults and anomalies in company infrastructures, enabling timely interventions and effective maintenance scheduling.

5.3 Artificial Intelligence and Process Optimization

Generative artificial intelligence (GenAI) is emerging as a powerful tool for optimizing production processes. According to a Deloitte research, 67% of companies have increased their investments in Generative AI thanks to the positive results obtained so far, citing improved efficiency, productivity, and cost reduction as primary objectives. It is also observed that a significant portion of respondents have found other benefits, such as innovation and improvement of products and services. (3)

5.4 Holistic Approach to Production Efficiency

To achieve optimal production efficiency, it is essential to adopt a holistic approach that integrates data analysis, implementation of advanced technologies, and a corporate culture oriented towards continuous improvement. This approach not only reduces operational costs but also improves product quality and the company’s competitiveness in the market.

- Synergy between Production Efficiency and Financial Needs

Production efficiency and a company’s financial needs are closely interconnected, with the optimization of production processes potentially having a significant impact on the company’s financial requirements. This relationship manifests through various mechanisms and can influence both short-term and long-term financial needs.

Financial need indicates the amount of monetary resources necessary to acquire the productive factors essential for carrying out business activities.

6.1 Impact of Efficiency on Working Capital

A more efficient production process can lead to a decrease in inventory stocks and more optimal management of customer receivables and supplier payables. This translates into a reduction of the Net Operating Working Capital (NOWC), which represents the financial need linked to the company’s operating cycle. A reduced NOWC implies a lower financial need to support the company’s current operations.

6.2 Optimization of Fixed Capital Investments

Production efficiency often requires initial investments in advanced technologies and machinery. However, in the long term, these investments can lead to a reduction in financial needs through: a) Lower maintenance and replacement costs b) Greater productivity per unit of invested capital c) Reduction of waste and energy costs

6.3 Impact on Cash Flows

A more efficient production process typically generates higher and more stable operating cash flows. This improves the company’s ability to self-finance, reducing dependence on external sources of financing.

6.4 Effect on Financial Structure

Production efficiency can positively influence the company’s financial structure, improving key indicators such as: a) The debt ratio: Financial debts / Net equity b) The interest coverage ratio: EBIT / Interest expenses

An improvement in these indices can result in a lower cost of capital and greater access to credit, positively influencing the company’s financial needs.

6.5 Impact on Financial Planning

Production efficiency allows for more accurate and stable financial planning. Reducing variability in production processes translates into more reliable forecasts of future financial needs, allowing the company to optimize liquidity management and capital structure.

6.6 Effect on the Cash Conversion Cycle

Production efficiency can reduce the cash conversion cycle (CCC) (4), defined as:

CCC = DSO + DIO – DPO

Where:

- DSO (Days Sales Outstanding) represents the average days of receivables collection

- DIO (Days Inventory Outstanding) the average days of inventory turnover

- DPO (Days Payables Outstanding) the average days of supplier payment

A reduced CCC implies a lower financial need to support the company’s operating cycle.

- Conclusion

Business strategy is a dynamic and collaborative process that requires a holistic approach adaptable to the specific needs of the company. Effective implementation of a strategy goes beyond mere compliance or corporate image, representing a concrete opportunity to innovate and improve sustainability in all aspects of the activity.

It is fundamental to integrate the strategy into daily operations, reviewing and adapting existing processes to align them with strategic objectives. This integration process should not be perceived as an additional burden, but as an integral part of business operation, requiring a culture oriented towards efficiency and continuous innovation.

The effective execution of the strategy, supported by strong leadership and the ability to adapt to changes, is what determines business success in the long term. The optimization of costs and revenues, accurate analysis of CAPEX and OPEX, integrated management of financial needs and liquidity, increased production efficiency, and understanding of the synergies between these elements are all crucial aspects of a complete and well-structured business strategy.

In a rapidly evolving business environment, a company’s ability to coherently integrate these elements and quickly adapt to new challenges and opportunities will be determinant for its success and long-term sustainability.

Sources:

(1) https://factwise.io/blog/post/sustainable-cost-reduction-via-procurement

(3) Deloitte’s State of Generative AI in the Enterprise – Quarter three report (August 2024)

(4) https://www.allianz-trade.com/en_US/insights/cash-conversion-cycle.html